SIP vs SWP: Understanding the Key Differences

Choose the right mutual fund strategy for your financial journey

Understanding the fundamental differences between SIP and SWP

Table of Contents

Introduction

When it comes to mutual fund investments, two popular strategies often come up in discussions: Systematic Investment Plans (SIPs) and Systematic Withdrawal Plans (SWPs). Though they sound similar, they serve entirely different purposes in an investor's financial journey. Understanding the difference between these two investment approaches is crucial for making informed decisions that align with your financial goals.

In this article, we'll break down the key differences between SIP and SWP, explore their unique benefits, and help you determine which might be more suitable for your specific financial situation and objectives.

What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is an investment method that allows you to invest a fixed amount regularly (typically monthly) into mutual funds. This approach embodies the concept of disciplined investing where you consistently allocate money towards your financial goals.

With SIP, you're essentially buying more units when prices are low and fewer units when prices are high, which helps in averaging out your purchase cost over time. This strategy, known as rupee cost averaging, can potentially reduce the impact of market volatility on your investments.

Key Features of SIP:

- Regular investments: Fixed amount invested at regular intervals

- Wealth accumulation: Primarily designed for building wealth over time

- Long-term approach: Best suited for long-term financial goals like retirement planning

- Power of compounding: Benefits from compounding returns over extended periods

- Rupee cost averaging: Minimizes the impact of market volatility

What is a Systematic Withdrawal Plan (SWP)?

A Systematic Withdrawal Plan (SWP) is essentially the opposite of a SIP. Instead of regularly investing money, you withdraw a predetermined amount at regular intervals from your existing mutual fund investments. This strategy is particularly beneficial for those looking to generate a steady income stream from their accumulated investments.

SWP allows you to maintain liquidity while keeping your principal amount invested, potentially enabling it to continue growing. This makes it an excellent option for retirees or individuals seeking supplementary income without liquidating their entire investment at once.

Key Features of SWP:

- Regular withdrawals: Fixed amount withdrawn at regular intervals

- Income generation: Primarily designed for creating a steady income stream

- Preservation with growth: Maintains potential for remaining corpus to grow

- Tax efficiency: Can be more tax-efficient than lump sum withdrawals

- Retirement planning: Ideal for post-retirement income needs

Advertisement

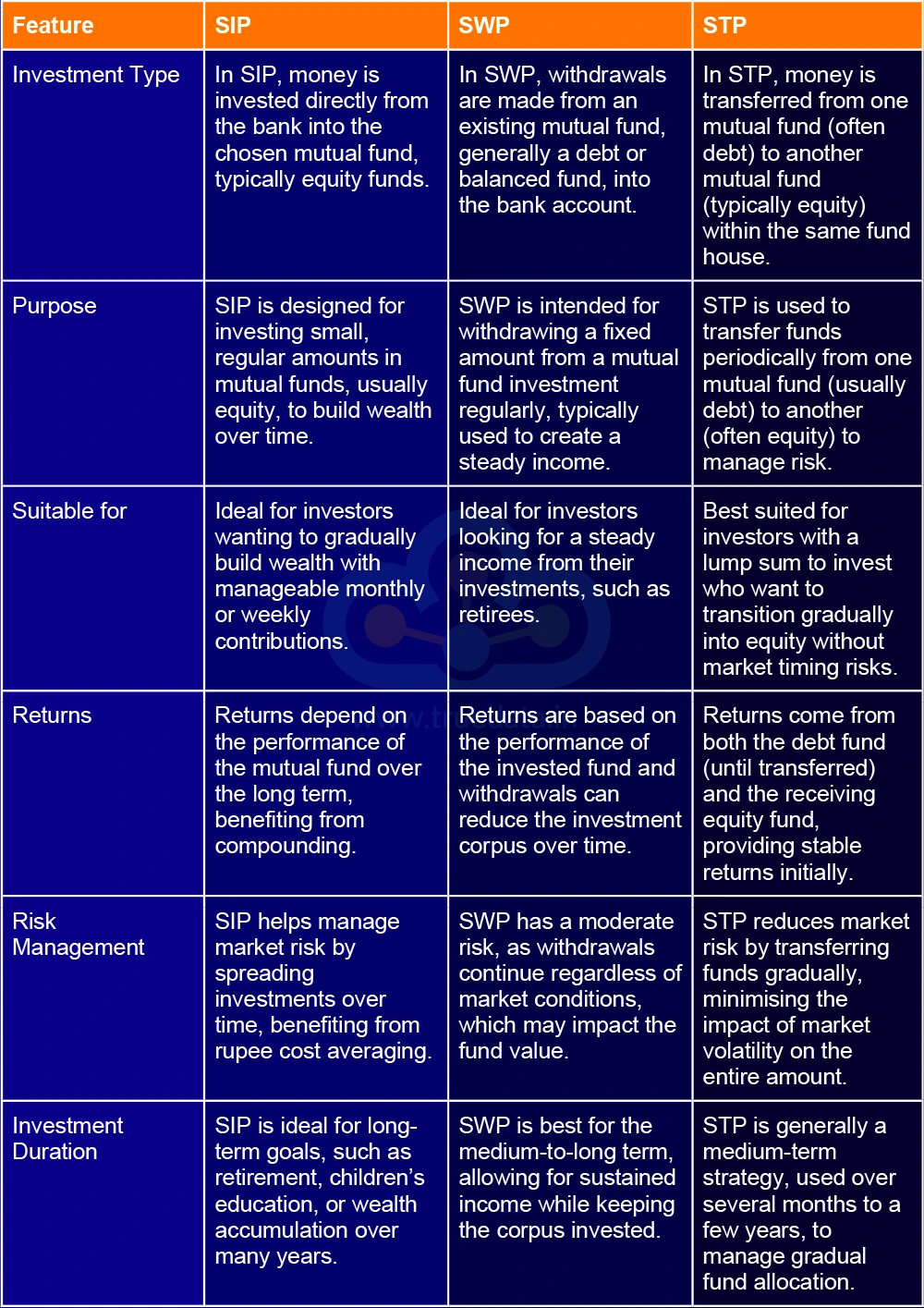

Key Differences Between SIP and SWP

While SIP and SWP might seem like two sides of the same coin, they cater to distinctly different investment objectives and life stages. Let's look at a side-by-side comparison:

Detailed comparison between SIP and SWP

Direction of Cash Flow

The most fundamental difference is the direction of cash flow. In a SIP, money flows from your bank account into a mutual fund, while in an SWP, money flows from your mutual fund investment back into your bank account.

Investment Objective

SIPs are designed for wealth creation and capital appreciation over the long term. They help you build a corpus by regularly investing small amounts. SWPs, on the other hand, are meant for income generation from an already accumulated corpus, making them suitable for those who need regular income.

Life Stage Suitability

SIPs are typically more suitable for individuals in their earning years who are looking to build wealth for future goals. SWPs are more appropriate for those who have already accumulated wealth and are now looking to utilize it, such as retirees or those needing supplementary income.

Market Impact

During market downturns, SIPs can be advantageous as they allow you to buy more units at lower prices. However, SWPs might be disadvantageous during such periods as withdrawals may lead to selling units at lower prices, potentially eroding your capital faster.

Choosing the Right Plan for Your Goals

Selecting between SIP and SWP depends largely on your financial goals, time horizon, and current life stage. Here's a guide to help you decide:

Consider SIP if:

- You're in the wealth accumulation phase

- You have a regular income source

- You're planning for long-term goals like retirement, children's education, or buying property

- You want to benefit from rupee cost averaging and the power of compounding

- You prefer a disciplined approach to investing

Consider SWP if:

- You've already built a substantial investment corpus

- You need regular income from your investments

- You're retired or approaching retirement

- You want to maintain liquidity while keeping your principal invested

- You're looking for a tax-efficient way to generate income

Pro Tip: Combining SIP and SWP

It's worth noting that SIP and SWP aren't mutually exclusive. You can use both strategies simultaneously for different financial goals. For instance, you might have a SIP running for your retirement while using an SWP from another fund for your child's education expenses.

Conclusion

Both SIP and SWP are powerful tools in an investor's toolkit, each serving different purposes in your financial journey. SIPs help you build wealth through disciplined, regular investments, while SWPs help you utilize your accumulated wealth by providing a steady income stream.

The choice between SIP and SWP should align with your current financial situation, investment objectives, and life stage. If you're still in your earning years and looking to build wealth, SIPs are likely more suitable. If you've already accumulated a substantial corpus and need regular income, SWPs might be the better option.

For personalized advice, consider consulting with a financial advisor who can help tailor a strategy that combines these tools optimally based on your specific needs and goals. Remember, the key to successful investing lies not just in choosing the right investment vehicle but also in aligning it with your unique financial journey.

Learn More About Financial Planning

Our team of financial experts is creating more helpful resources to guide you through your investment journey. Check back soon for new articles on taxation, investments, and personal finance strategies.

Back to Learn SectionAdvertisement